In 2014, Jia Yueting established Farady Future (hereinafter referred to as FF) when LeEco was in full swing. He could not have imagined that this company would become the only "life-saving straw" after LeEco's collapse, and this straw has been lucky to survive until now. Usher in the opportunity to stand up.

Recently, Faraday Future will go public through a merger with Property Solutions Acquisition Corp. (PSAC), and the combined company will be valued at US$3.4 billion. It will become another new energy vehicle company listed through SPAC. It is expected in the second quarter of 2021. Landed in US stocks. SPAC is a popular way of listing in the U.S. stock market. It can be simply understood as a "backdoor" listing.

Although the news has not been further revealed, FF, which has not appeared in front of the public for a long time, has once again returned to people's sight. After experiencing the repeated ups and downs, why can FF "live"?

Listing, financing, FF is a bit busy

According to Reuters, the transaction was backed by a private investment of US$775 million, and Chinese automaker Geely will become the main investor in the private placement.

Subsequently, Geely Holding Group issued an announcement stating that it had signed a framework cooperation agreement with Faraday Future, "At the same time as a financial investor, Geely Holding Group also participated in a small amount of investment in the listing of Faraday Future SPAC." This small amount of investment vaguely negates the main investment above. Rumors of the author.

But Geely's participation in FF also made people curious about FF. In an FF listing roadshow PPT obtained by Geek Park (ID: geekpark), it was mentioned that FF, Geely Holdings and a Tier 1 Chinese City (Tier 1 Chinese City) provide opportunities for FF in China. Although there is no explicit statement, various sources indicate that the city that cooperates with FF is likely to be Zhuhai.

Of course, this roadshow PPT also revealed more information about the FF company. The Geek Park extracts the most noteworthy points and arranges them as follows:

1. FF91 will be launched within one year of listing

1050 horsepower, acceleration from one hundred kilometers in less than 2.4 seconds, lidar, L3 level autopilot technology... Several obvious automotive technology labels are affixed to Faraday Future’s first model FF91, which became more eye-catching in the automotive industry at CES in early 2017 The presence. At that time, FF officially released information that within 36 hours after the FF91 conference, more than 64,000 bookings were received. However, due to the delay in launching FF91, the number of reservations has also been greatly reduced. The roadshow PPT shows that the number of reservations for FF91 is currently 14,000.

Front view of FF91, the model originally planned for mass production in 2018 has not been produced until now | Faraday Future

Front view of FF91, the model originally planned for mass production in 2018 has not been produced until now | Faraday FutureFaraday Future founder and CEO at the time Jia Yueting said that FF91 will be launched at the end of 2018, and that it will not "bounce tickets" for a year and a half after that. But the reality is that until today, FF91 has not been mass-produced.

FF mentioned that FF91 will be launched within 12 months after its launch. The factory in Hanford, California is expected to be completed by the end of 2021, with an annual production capacity of 10,000 vehicles.

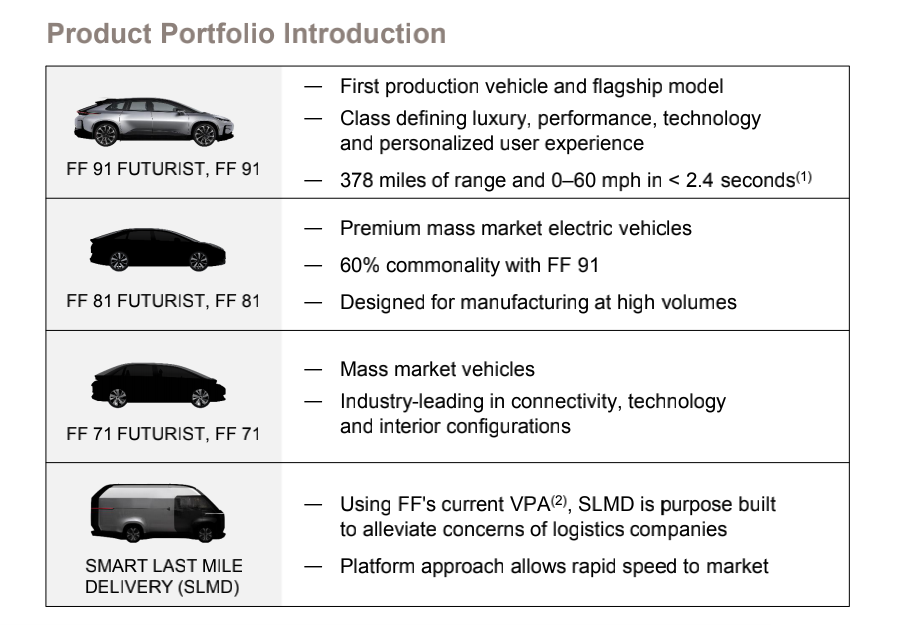

2. Cheaper models will be launched in the future

Although FF91 is positioned as a luxury electric vehicle, from the perspective of FF's development route, its models will be further popular in the future.

According to FF's plan, after FF91, the company has three more models arranged into product series. The three products are FF81, FF71 and the last mile delivery vehicle (SMART LAST MILE DELIVERY, abbreviated as SLMD).

FF81 is still positioned as a high-end electric vehicle, 60% of which are shared with FF91, which can basically be understood as a shared platform. The low-profile version of FF91 has a larger sales volume than FF91; FF71 is completely aimed at the mass market This layout has a bit of Tesla’s shadow: Start with high-end vehicles, and gradually expand the user base with more friendly models.

The last model, SLMD, does not belong to the FF series, but this car will use FF's VPA platform architecture for use in the commercial field, and it may be for logistics companies in the future. FF did not mention this car too much, but in 2019, FF reached an agreement with the Ninth City of the Chinese Internet company that the two parties will establish a joint venture company to build a car for the Chinese market, and this model called V9 It happens to be a minivan.

3. Blooming in China, Korea and the United States

In addition to the annual production capacity of 10,000 vehicles in California, FF has also set its sights on the Chinese and Asian markets. FF stated that the company is signing an automobile manufacturing cooperation agreement in South Korea, which is expected to reach mass production in mid-2023, with an estimated annual output of 270,000 vehicles. In addition, a manufacturing base in China is also being established.

FF91 interior, the entire cockpit claims to have 10 screens | Faraday Future

FF91 interior, the entire cockpit claims to have 10 screens | Faraday Future4. Urgent need for funds

Of course, in this information, although FF's beautiful vision for the future and high expectations for smart electric vehicles are written on the surface, there are two words between the lines: lack of money.

It is not that FF has not received any money. From the company's past history, it can be roughly calculated that FF has received no less than US$4 billion in financing, including Evergrande's investment in mid-2018, which has since withdrawn.

Even so, FF still needs a lot of capital, which is why it went public.

Why can FF "stand tall"?

LeTV's capital chain broke, Jia Yueting went to the United States, Faraday Future released a new car but it was delayed in mass production. There has been no good news about the factory construction, and the love and hatred entanglements with investors have also been exposed to the public. After a series of operations that were not conducive to FF, FF still "survived" and was ready to go public in one fell swoop.

Having said that, after experiencing so many twists and turns, why can FF still be favored by capital?

Some clues may be seen from the investors and partners of FF's listing. For Geely, the most eye-catching one this time, a so-called "traditional car company" is looking for an upward transition to intelligence and electrification, but past attempts have failed to be like Weilai ES8 and Xiaopeng P7 Explosive products.

With the determination of the enterprise to change, how to move forward quickly to the goal has become Geely's most urgent matter. Whether it is the Lynk & Co ZERO, a pure electric vehicle under the Lynk & Co brand, or the establishment of a new pure electric vehicle company, it is a related action. And FF, which entered the smart electric vehicle early on and is positioned in the field of technology, may be one of the role models for Geely to "learn" during its transformation.

According to the announcement issued by Geely, Geely Holding Group and FF plan to cooperate in the field of technical support and engineering services, and explore the possibility of providing foundry services by the joint venture between Geely and Foxconn. Combining previous investments means that Geely is not just a "foundry" role.

http://www.klubsaham.com/forum/topic/28889/?page=1#post-885316

https://www.tmuts.com/board/board_topic/5426374/4090141.htm?page=1

https://www.humandesignforeveryone.com/board/board_topic/5096042/4166510.htm?page=1

http://www.dailymagazine.news/news-nid-663343.html#comment_formx

https://www.thepetservicesweb.com/board/board_topic/2635323/4516464.htm?page=1

https://warezhero.com/wwwwarezherocom/46239-hair-there-and-everywhere-a-book-about-growing-up.html

https://www.milliescentedrocks.com/board/board_topic/2189097/4351166.htm?page=1

http://www.musicrush.com/nyra/blog/14434/reasons-that-can-lead-to-hair-loss

http://asmtm.esportsify.com/forums/Main-Forum/1757/what-are-the-main-causes-of-hair-loss

https://www.alkalizingforlife.com/board/board_topic/6120136/5344230.htm?page=2

https://wareham.granicusideas.com/ideas/top-hair-cutting-experts

https://www.tai-ji.net/board/board_topic/4160148/1427260.htm?page=1

http://www.motherpedia.com.au/article/lets-talk-about-hair-loss

https://demo.evolutionscript.com/forum.php?topic=19051&p=2&

https://www.saintpaulfamily.com/board/board_topic/6534426/4124234.htm?page=3

https://www.ancientforestessences.com/board/board_topic/349324/3113305.htm?page=1

https://www.innerbeautybelle.com/2019/01/my-hair-is-falling-out.html?showComment=1614088069662

http://www.bellamalone.com/2017/08/bringing-my-hair-back-to-life-with.html

http://bargain.ratebe.com.au/p12438/Lawyers-from-romania.html

https://www.tmuts.com/board/board_topic/5426374/5272162.htm?page=1

http://www.dailymagazine.news/news-nid-1281412.html#comment_formx

https://www.humandesignforeveryone.com/board/board_topic/5096042/5502304.htm?page=1

https://www.thepetservicesweb.com/board/board_topic/2701171/5140540.htm?page=1

https://www.milliescentedrocks.com/board/board_topic/2189097/4032021.htm?page=1

http://www.letmetalk.info/discussions/best-law-essay-writing-service.html

https://www.therestaurantsweb.com/board/board_topic/3906811/5508862.htm?page=1

http://www.musicrush.com/freedomlaw62/blog/77626/the-freedom-law

https://www.portlandfishingtrips.com/board/board_topic/5380397/5506841.htm?page=1

https://www.alkalizingforlife.com/board/board_topic/6120136/1793510.htm?page=1

https://www.tai-ji.net/board/board_topic/4160148/2165189.htm?page=1

http://m.manbottle.com/humor/Laws_of_Physics

http://www.clubwww1.com/dating/member/blog_post_view.php?postId=76821

https://www.saintpaulfamily.com/board/board_topic/6534426/5319897.htm?page=1

https://www.ancientforestessences.com/board/board_topic/349324/5525501.htm?page=1

http://inoideas.org/content.php?mode=2&content_id=3096&content_type_id=1

https://demo.evolutionscript.com/forum.php?topic=4420

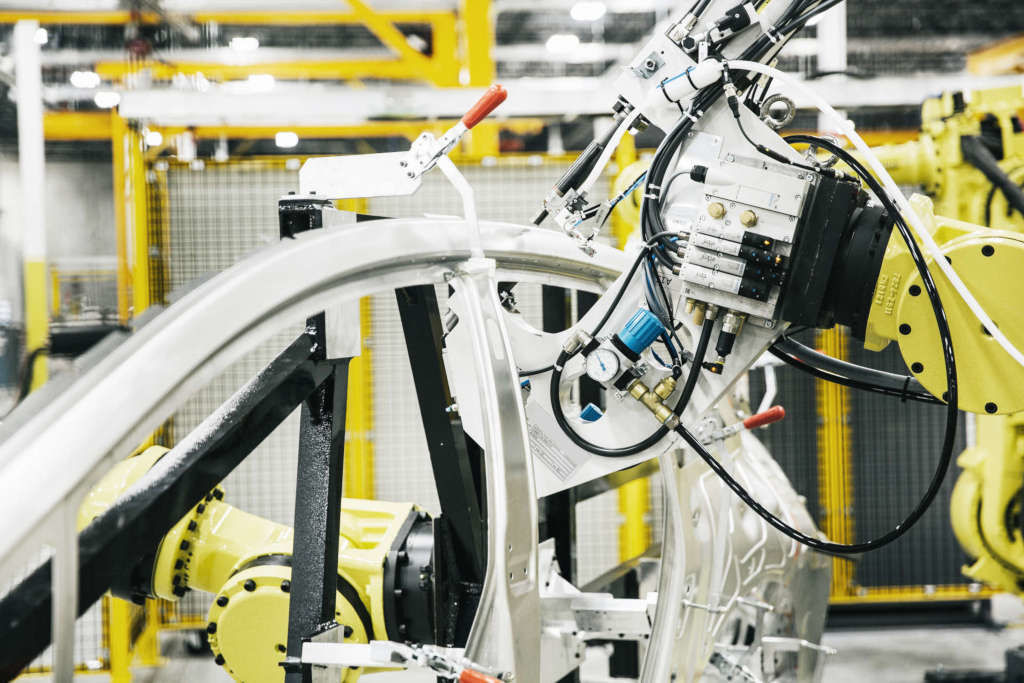

FF91 is making | Faraday Future

FF91 is making | Faraday FutureAs for the rumors of Zhuhai State-owned Assets' investment in FF, it needs to be viewed in a different way.

On the one hand, the Hefei government bet on Weilai to make a fortune, allowing local governments to see the positive results of investing in the new energy vehicle industry. In 2020, when the new energy vehicle fires, whether it is the secondary market or the general public, they will see the huge opportunities in the reform of the automotive industry. Geek Park mentioned in a summary article at the end of 2020 that the activeness of new cars in the capital market represents to a certain extent that people have gradually reached a consensus on the fact that “intelligence and new energy belong to the future trend”.

Among them, there are not many investment targets that investors can choose. Chinese companies that have not yet been listed include Weimar, Gaohe, and Leaprun. Only Byton and FF have Chinese and overseas elements. The first three companies have found strong funds or support from local governments. Byton has also received support from Foxconn and is restarting. FF may be the state of "all things ready and only owed funds" among the remaining companies. "From a market perspective, investing in a company that achieves 80% is always much less risky than a company that starts from 0. This is understandable." An industry insider told Geek Park.

FF's current CEO Carsten Breitfeld (Carsten Breitfeld), who was previously the co-founder of Byton, another new car maker | VISION CHINA

FF's current CEO Carsten Breitfeld (Carsten Breitfeld), who was previously the co-founder of Byton, another new car maker | VISION CHINAFF mentioned in the roadshow PPT that FF91 has completed most of the vehicle development, including inverters, motors and gearboxes, battery management systems, etc.; and the procurement process of the remaining parts has been completed 94%. After the 2017 CES, ideal car founder Li Xiang gave an evaluation of the FF91: "As a smart electric car, the FF91 is clearly ahead of the traditional car brand design in terms of design concept and technical presentation. The concept car that came out is definitely worthy of recognition."

In other words, FF hopes to obtain a fund to solve the problem of vehicle production.

Even so, with the background of LeTV and Jia Yueting himself, FF, with a not-so-glamorous resume, has also consumed corporate credit in the past. How can a company that has not launched a product for 4 years convince people again? At the end of January, several former FF employees gave their opinions in a discussion about the listing of FF in ClubHouse.

The former employees of FF gave a high evaluation to Jia Yueting himself, believing that Jia Yueting is an entrepreneur who really does things. Jia has a certain influence on FF's follow-up search for financing and can make others believe that FF can be done. , Even if it failed many times before. As for why a large amount of financing cannot be launched, it may have a lot to do with the low capital utilization rate.

Geek Park tried to contact several former employees of FF, but no response was received.

Faraday Future founder Jia Yueting, currently Faraday Future CPUO (Chief Product and User Ecological Officer) | Vision China

Faraday Future founder Jia Yueting, currently Faraday Future CPUO (Chief Product and User Ecological Officer) | Vision ChinaBut it must not be denied that FF has seized the opportunity again. China’s new car-making forces have collectively completed their advancement, and technology companies are entering the market. Globally, traditional car companies are intensively embarking on transformation, and startup companies can also make a leap in the capital market with the story of smart electric vehicles.

Lucid is a typical case. This electric car company, which was first established in the United States, started almost at the same time as Tesla. It is regarded as one of the new forces in the United States to make cars and has high hopes.

Interestingly, Jia Yueting was once Lucid's largest shareholder, holding close to 40% of the shares. But with the shortage of FF funds, Jia Yueting later sold his Lucid shares. It was not until the end of 2018 that Lucid received 1 billion US dollars from Saudi Arabia's sovereign wealth fund to continue its corporate development. In 2018, Tesla has sold 245,240 cars, which is equivalent to the total of the company since its establishment in 2003 to 2017.

In the end, Lucid, like FF, began to impact the listing of SPAC, with a valuation of 24 billion US dollars, which is 7 times that of FF; Lucid also began to consider entering the Chinese market and investing in the construction of factories in China.

Therefore, regardless of whether the car is built or not, whether the company will develop smoothly in the future, seizing the opportunity may be the most important thing they should do in this possibly best era.

Comments

Post a Comment